We’ve spent a lot of time this semester talking about expenses you’re likely to incur over the course of your life. There are also ways you can make money, in addition to earning a salary. Through investment vehicles (things you invest in) like bonds, stocks, and mutual funds you can increase your net worth. Some investments are riskier than others, so make sure you understand how various investment vehicles work, the risks involved, and which vehicle best fits your personality. Some people are inherently risk-takers, while others or not. This may affect how you invest. There is no one right way, so do what works best for you. Do be aware that risk and financial return are linked; the riskier the investment, the greater the potential return.

Some people invest in bonds, a type of fixed-income security. When you purchase a bond you are lending a company or the government money with the expectation that they will pay back the full loan amount with interest. Payments are made regularly according to a schedule, which is why bonds are classified as fixed-income securities. Bonds are relatively safe investments; therefore, they have a lower expected return than stocks or mutual funds. Here’s how Investopedia explains bonds:

“Say you buy a bond with a face value of $1,000, a coupon of 8%, and a maturity of 10 years. This means you’ll receive a total of $80 ($1,000*8%) of interest per year for the next 10 years. Actually, because most bonds pay interest semi-annually, you’ll receive two payments of $40 a year for 10 years. When the bond matures after a decade, you’ll get your $1,000 back.”

This means that over 10 years, you will receive $800 in interest. That’s almost the full amount of your original investment!

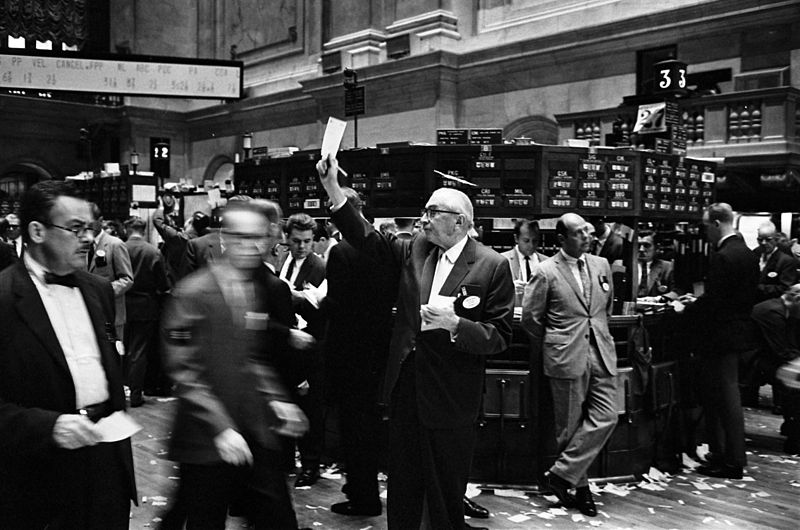

Stocks are another common investment vehicle. You’re probably at least vaguely familiar with the New York Stock Exchange and NASDAQ, both of which are large stock exchanges in the United States. When you invest in the stock market, you become a shareholder, or part-owner, of a company. Stocks are riskier than bonds because their value changes daily and there is no schedule of payment. However, you have greater potential to profit from your investment. Some companies give shareholders some of their profits, called dividends. Other times shareholders make money only if the stock price goes up.

Another type of investment are mutual funds. One well known mutual fund is the S&P 500 index fund, though many funds exist. To invest in mutual funds, you pool your money with other investors and then have a professional financial advisor invest that money in a variety of stocks and bonds. One advantage to mutual funds is that you save yourself time because you do not have to determine which investments to pursue; you let a professional do the work. Mutual funds do have extra costs, however, such as paying the professional who invests your money.

If you start investing early in life, you will once again discover how powerful compound interest is. Remember that compound interest is “interest on interest,” and over time it can lead to much larger financial returns than simple interest. See the blog post from February 17 to read more on compound interest.

Below are a few more resources on investing. There are plenty of details that we didn’t cover here, so make sure you do your research and talk to a financial advisor before making any final decisions!

In Andersen Library:

- A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing, Burton G. Malkiel. Call Number: HG4521 .M284 2003, Main Collection

- The Intelligent Investor: A Book of Practical Counsel, Benjamin Graham. Call Number: HG4521 .G665 2006, Great Minds and other locations

- How the Stock Market Works: A Beginner’s Guide to Investment, Michael Becket. Call Number: HG4529.5 .B43 2012, Main Collection

- Everyone’s Money Book on Stocks, Bonds, and Mutual Funds, Jordan Goodman. Call Number: HG4921 .G66 2002, Main Collection

- Find the Right Mutual Funds. Call Number: HG4530 .F526 2005, Main Collection

Other Resources:

- Investopedia’s Investing 101. This provides a great overview of investing. Investopedia also has specific overviews of bonds, stocks, and mutual funds.

- Investor.gov Investing Basics. The information presented is from the US Securities and Exchange Commission.

Note: This blog post is for informational purposes only. No content should be construed as financial advice.