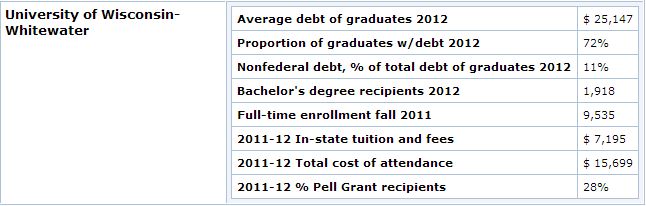

A few weeks ago we talked about saving money for things we want in the future. This week we’re going to discuss one of the expenses that makes saving difficult: Student Loans. Below is a graph that describes the situation of UW-Whitewater students who graduated in 2012, according to Institute for College Access and Success:

Using the Federal Student Aid Repayment Estimator, we can determine how long it will take you to pay back your loan of $25,147. For loans first disbursed between the beginning of July 2008 and the end of June 2009, the interest rate is 6.0%. You file using the tax filing status of single. According to the NACE Salary Survey, the average starting salary for class of 2012 graduates was $44,259. If you get a job as soon as you graduate with the average salary, your repayments, using a standard repayment plan, will be $279 per month for 10 years. Over that period, you will have paid $8,355 in interest.

Now let’s say you don’t get a job right after graduation. Instead you work part time as a bartender earning the 2012 median pay of $18,900 per year, according to the Occupational Outlook Handbook. You probably won’t be able to afford $279 per month under the standard repayment plan. Instead, you apply for Income-Based Repayment. Your payments may be as low as $21, but you’ll be paying off your loan for 25 years and you’ll accrue more than $37,000 in interest. Even after all that, you’ll still have to rely on loan forgiveness.

What happens if you absolutely cannot make a loan payment? You risk defaulting on your loans, which is a less than great situation. If you are delinquent on your loans, it can negatively affect your credit score. We’ll go more in depth in a few weeks, but having a poor credit score makes it more difficult for you to: get a mortgage; get a car loan; rent an apartment; sign up for utilities; etc. If you think you will miss a payment, contact your loan service provider immediately. They may be able to help you change your payment due date or modify your repayment plan.

It’s clear that student loans can become a huge burden, especially if your plan to become a scientist doesn’t pan out. It’s important to understand your financial situation and to make loan payments on time. It’s even more important to make sure you don’t borrow more than you really need while in school. You may be stretched thin for a few years, but you’ll pay less in interest in the long run. Make your loan payments part of your budget so you don’t risk default. If possible, you can also pay more than the minimum amount to pay off your loan more quickly.

Below are a few resources to help you manage your loans and choose a repayment plan. You can also check out the book Aiding Students, Buying Students: Financial Aid in America, by Rupert Wilkinson, at Andersen Library.

Note: This blog post is for informational purposes only. No content should be construed as financial advice.