Even if you don’t have student loans, which we discussed last week, you will probably have other kinds of loans at some point in your life. One example is a vehicle loan. Unless you plan to live in a place like New York City, you’ll probably need a car to get to and from work, the grocery store, etc. According to USA Today, the average price of a new car in August 2013 was $31,252 (though it’s important to remember that you don’t have to buy a new car). Your ability to pay for a car, new or used, outright as a fresh college graduate is unlikely, so it’s important to understand the way car loans work.

You have a few options for obtaining financing for a car. Direct lending means a finance company, bank, or credit union loans you the money you need for the car and you agree to pay that money back with interest. Dealership financing is the same thing, but you sign a contract with the dealer rather than a banking institution. With dealership financing, the interest rates will likely be a little higher. However, this option is often more convenient and more timely than applying for a loan through a banking institution. According to the Federal Trade Commission, the interest rate you will pay on your loan is determined by a number of factors, including your credit history, current finance rates, competition, market conditions and special offers. If your credit score is relatively low, you may need a co-signer (such as a parent) on the contract. We’ll talk about credit in detail in a few weeks.

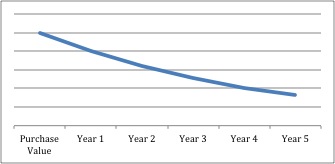

Another option is leasing a vehicle. Just like renting an apartment, you would be using the car for a time but you would not actually own it. When you lease a car, as opposed to buying a car, your payments will likely be less each month because you are only paying depreciation expenses, rent, taxes, and fees. Depreciation is “a method of allocating the cost of a tangible asset [such as a car] over its useful life” (Investopedia). This is what people are talking about when they say a new car loses a lot of value as soon as it leaves the dealer’s lot. Cars depreciate a lot initially and then less and less over time, creating a graph that looks a lot like this:

You can see the graph is already staring to flatten by the end of year five. Depreciation is an important consideration when deciding whether to purchase a new or used vehicle. Unless you plan to drive a car until it dies, it may not be worth it to buy a brand new vehicle.

Whether you decide to purchase or lease a vehicle, you have to make sure the vehicle you are looking at is affordable for someone in your current position. According to an article published by Business Insider, “Many personal finance experts suggest the 20-4-10 rule. It means you should have a 20 percent down payment on a car loan, borrow for no more than four years and make sure car payments are no more than 10 percent of your gross income.” Revisit your budget and see what repayment plan will work best. You can use an auto loan calculator to help you visualize how long it will take you to pay off a car and get an estimate of the amount you will need to pay each month. Don’t purchase your dream car right away. Be okay with driving adequate vehicles right now and saving up for something nicer in the future.

You can read Consumer Reports online through several of Andersen Library’s databases to determine which new or used cars might be a good investment for you!

Note: This blog post is for informational purposes only. No content should be construed as financial advice.